Does Car Color Affect Car Insurance Costs in Florida?

Some people wonder, do red cars cost more to insure in Florida? The truth is, they don’t. In Florida, insurance costs are determined by factors such as your driving history, the type of car you own, and your location. Experts confirm that car color has no impact on insurance rates. According to InsuranceQuotes.com, this is just a myth, and Kristofer Kirchen points out that color isn’t even a question on insurance forms.

Key Takeaways

The color of your car doesn’t change insurance costs in Florida. Insurance prices are based on your driving history, car type, and where you live.

Keeping a good driving record is very important. Crashes and tickets can make your insurance cost a lot more.

Tell your insurance company about changes, like new paint jobs. This helps make sure your car is properly covered.

Do Red Cars Cost More to Insure in Florida?

How Insurance Companies Decide Premiums

Insurance companies have a specific way to set premiums. They look at risks, not things like car color. When you apply for insurance, they check your driving record, car details, and other data. This helps them figure out how likely you are to make a claim.

Here’s how they decide premiums:

Driving Record: If you have accidents or tickets, you’ll pay more. A clean record means lower costs.

Vehicle Type: Your car’s make, model, and age affect the price. Sports or luxury cars cost more because repairs are expensive.

Location: Where you live matters. High-crime or bad-weather areas raise premiums.

Personal Factors: Your age, driving experience, and credit score are considered. Older, experienced drivers with good credit pay less.

This method ensures premiums are based on real risks, not car color or other unimportant details.

Proof Against the "Red Cars Cost More to Insure" Myth

The idea that red cars cost more to insure isn’t true. Research shows insurers don’t care about car color. They focus on things like your driving history and car type. Loretta Worters from the Insurance Information Institute says accidents and mileage matter more than color.

Data also proves this myth wrong. While people think red cars speed more, studies show white cars get the most tickets, then red cars. Police don’t target red cars more often. Also, insurance studies show red cars don’t have higher premiums than other colors.

Why People Still Believe the Myth

Even with proof, many still think red cars cost more to insure. This belief comes from linking red with aggressive driving. Loretta Worters explains, “People think red cars cost more because they’re seen as fast or risky.”

In the past, red car drivers were 2.1 times more likely to get speeding tickets than green car drivers. But insurers don’t use this to set premiums. They care about claims history and car type. This myth shows how false ideas can seem true over time.

Factors That Affect Car Insurance Costs

Car insurance prices depend on many things. These factors help companies decide how risky you are to insure. Let’s look at what affects your insurance costs.

Driving Record and Claims History

Your driving history is very important for insurance rates. If you’ve had accidents or tickets, you’re seen as risky. This means you’ll pay more. A clean record can lower your costs.

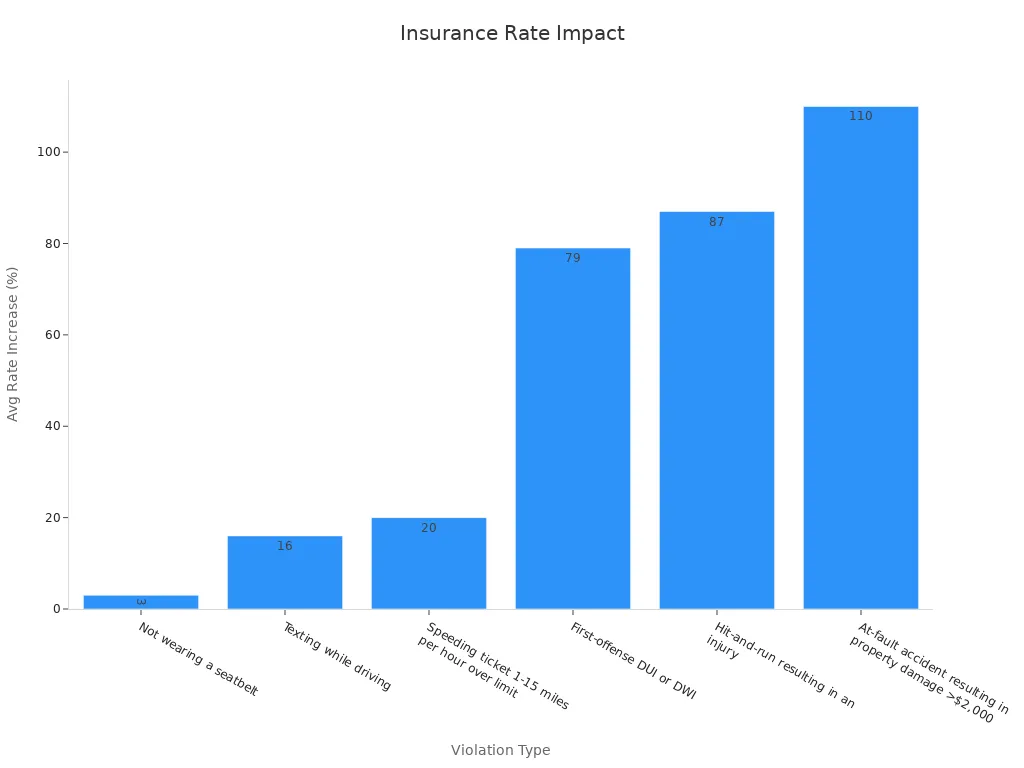

For example, some violations raise your rates a lot. Here’s how different problems affect costs:

Violation Type | |

|---|---|

Not wearing a seatbelt | 3 |

Texting while driving | 16 |

Speeding ticket 1-15 miles per hour over limit | 20 |

First-offense DUI or DWI | 79 |

Hit-and-run resulting in an injury | 87 |

At-fault accident resulting in property damage >$2,000 | 110 |

As you can see, serious issues like a DUI or hit-and-run make rates go way up. Keeping a clean record is the best way to save money on insurance.

Vehicle Type, Make, and Model

The car you drive changes your insurance cost. Companies look at your car’s make, model, and age. Different cars have different risks. For example:

Sports cars cost more because they’re fast and repairs are pricey.

Luxury cars are expensive to fix, so they cost more to insure.

Older cars may cost less to insure since repairs are cheaper.

Choosing a safe car with low repair costs can help you save money.

Location and State Rules

Where you live affects your insurance price. Companies check local risks. In Florida, these things matter:

Factor | Description |

|---|---|

High Crime Areas | More theft or vandalism means higher insurance costs. |

Traffic Density | Busy areas with lots of cars have more accidents, raising rates. |

Places with hurricanes or floods have higher insurance costs. | |

Repair Costs Variability | Local repair prices change insurance rates. |

Regional Regulations | Florida’s required personal injury protection (PIP) raises costs. |

Parking and Storage | Where you park your car can affect your insurance price. |

If you live in a high-risk area, you’ll pay more. Florida’s special rules, like PIP coverage, also make insurance more expensive.

Personal Details: Age, Gender, and Credit Score

Your age, gender, and credit score also matter for insurance. Companies use these to figure out your risk. Here’s how they affect costs:

Factor | Description |

|---|---|

Age | Young drivers pay more because they’re less experienced. |

Gender | Rates can differ by gender based on risk data. |

Credit Score | A better credit score can lower your insurance costs. |

For example, drivers under 25 usually pay more. Improving your credit score can also help you save money on insurance.

Debunking Myths About Auto Insurance

The Truth About Red Cars and Insurance Costs

You might think red cars cost more to insure. This is a popular myth, but it’s not true. Insurance companies don’t care about your car’s color. They focus on things like your driving record and car type.

Experts say red cars don’t have higher insurance costs. Insurers usually don’t ask about car color when setting rates. People believe red cars cost more because red seems fast or bold. But this idea doesn’t affect your insurance price.

Do Custom Paint Jobs Cost More to Insure?

Custom paint jobs can raise your insurance costs. Unlike regular colors, custom paint makes your car worth more. This increases repair or replacement costs. If you have a special paint job, extra coverage may be needed.

Insurance companies include customizations in your car’s value. If you don’t tell them, repairs might not be fully covered. To avoid problems, inform your insurer about any changes, like custom paint.

Are Certain Car Colors Safer or Cheaper to Insure?

Car color doesn’t change insurance rates directly. But lighter colors, like white or silver, might be safer. These colors are easier to see, which could lower accident risks. Still, this doesn’t make them cheaper to insure.

Insurance rates depend on things like accidents and repair costs, not color. Whether your car is red or white, your rates rely on your driving and coverage choices.

Car color, like red, doesn’t change insurance costs in Florida. Insurance prices depend on your driving record, car type, and location. For example:

Your driving history and where you live affect costs most.

Car color doesn’t raise or lower insurance prices.

Drive safely and compare insurance quotes to save money.

FAQ

Does my car's color affect how much I can sell it for?

Yes, car color can impact resale value. Common colors like white, black, and silver sell quicker. Rare colors might attract fewer buyers, lowering demand.

Should I tell my insurance company about changes like a new paint job?

Yes, always tell your insurer about changes. Custom paint jobs make your car worth more. If you don’t, repairs or replacements might not be fully covered.

Do some car colors make accidents less likely?

Yes, lighter colors like white or silver are easier to see. This can reduce accident risks, especially at night. But insurers don’t use color to set rates.

The information on this website is for general information purposes only. Nothing on this site should be taken as legal advice for any individual case or situation. This information is not intended to create, and receipt or viewing does not constitute an attorney-client relationship.